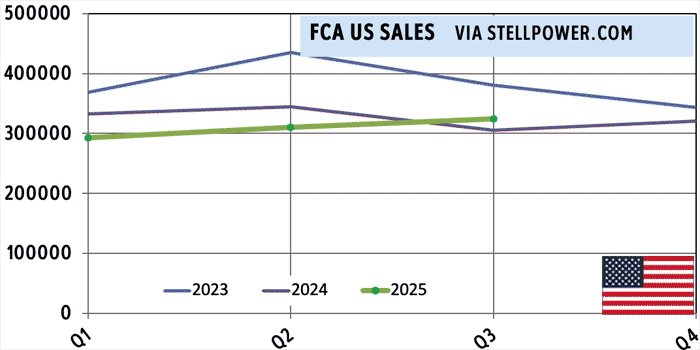

Stellantis’ American arm, FCA US, may be turning the corner, as sales have increased by 6% over the third quarter of 2024. Ram saw a 26% increase in retail sales, but some of the good news was driven by a 22% increase in commercial fleet sales. In addition, much of the gains took place in September, according to the FCA press release.

Year to date, FCA US is still down by 6%. Jeep is ahead by a few hundred vehicles, Ram is down by around 2,000 sales, Chrysler is down by 7% (around 6,400), and Dodge is painfully down by 38% (around 46,000 cars), mostly due to the loss of the Charger and Challenger. Fiat rose by 57%, which is under 500 cars, and Alfa Romeo dropped by 30%.

For the third quarter, Jeep came on strong with an 11% gain, which translates to an increase of around 15,500 vehicles; the increases were driven by the Wrangler, Gladiator, Wagoneer, and new Wagoneer S, countered by a drop in Compass sales. The Grand Wagoneer, Renegade, and Cherokee fell, but these were not large numbers to be begin with.

The low sales of the Grand Wagoneer, with just 1,303 selling over three months, suggests it has not quite gotten traction as a luxury barge, but on the other hand the investment to create it once the Wagoneer was in production was quite low, and it may well be generating profits. The Wagoneer itself had 16,597 sales for the quarter—impressive since year to date it’s just 30,213.

Ram has started splitting 1500 from other pickups and the chassis cabs, showing that Ram 1500 sales rose by 10% but are just about even with Heavy Dutys, which dropped by 11%, so the total is down by 1%. (Year to date the share is roughly the same.) ProMasters dropped by around 21%, but are still selling reasonably well; another 18 Citys also sold out of inventory.

At Chrysler, dealers scrounged up another 71 300s to sell. The Voyager was listed separately with 0 sales for 2024; Pacifica sales remain poor, with 32,417 sold in the quarter, a 30% gain over the poor third quarter of 2024. Year to date, though, the company has sold over 90,000 minivans, and is likely to be #2 in sales.

At Dodge, the decimated product line is showing; though dealers found six Darts, eight Caravans, and 13 Journeys, that didn’t quite make up for the loss of the Charger and Challenger. The Durango, now with standard V8s, rose by 44% to 20,018, becoming the most popular Dodge. The Hornet was #2, at 2,839, and that’s with a 26% drop from Q3 2024; what’s more, there will be no 2026 Hornet. Dealers found 222 Challengers and 238 Chargers to sell. The new Charger Daytona saw 2,776 sales, with some dealers wanting more and others having too many.

Fiat dealers found 33 leftover Ls and Xs to sell, with the core 500 having 288 sales. Year to date, the electric Fiat doubled its own name to get 1,076 sales. Alfa Romeo had a bad quarter (down 21%), with every one of the three vehicles (Giulia, Stelvio, and Tonale) dropping. It turns out dropping Hornet sales do not mean buyers are turning to Tonales instead.

Year to date, all of the company’s big sellers are now trucks or Jeeps. The best seller, if we split pickups by standard and heavy duty, each come in with over 100,000 sales, but the best seller is the Jeep Grand Cherokee (if we don’t split the pickups, the Ram comes in on top). The next best seller would be the Ram 1500, then the Jeep Wrangler, then the Ram Heavy Duty, and then, in the six-figure club, nothing. The Compass (82,920) beats the Pacifica (78,364), unless you toss in Voyager sales (11,809).

Canadian sales fell by 8% for the quarter, and are down 12% for the year (see story); the Canadian-made Pacifica saw hefty gains, but otherwise there seems to be no pattern of success for Mexican-made vs USA-made vehicles.

David Zatz started what was to become the world’s biggest Mopar site (Allpar) in 1994. After a chemo-induced 2007-2010 break, during which he wrote car books covering Vipers, minivans, and Jeeps, he returned with Patrick Rall to create StellPower.com for daily news, and to set up MoTales for mo’ tales (Chrysler history and “permanent” car and truck pages). He most recently wrote Century of Chrysler, a 100-year retrospective on the marque.

Discover more from Stellpower - that Mopar news site

Subscribe to get the latest posts sent to your email.