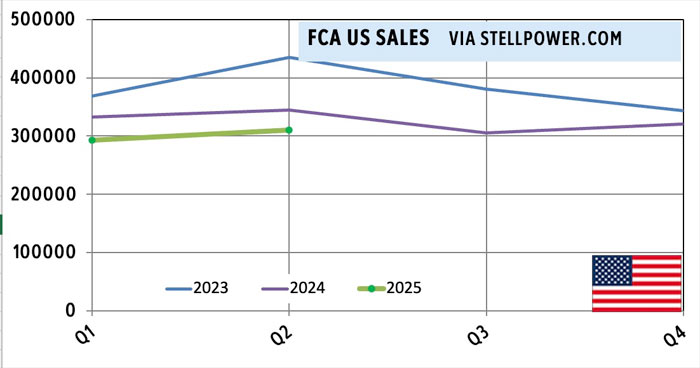

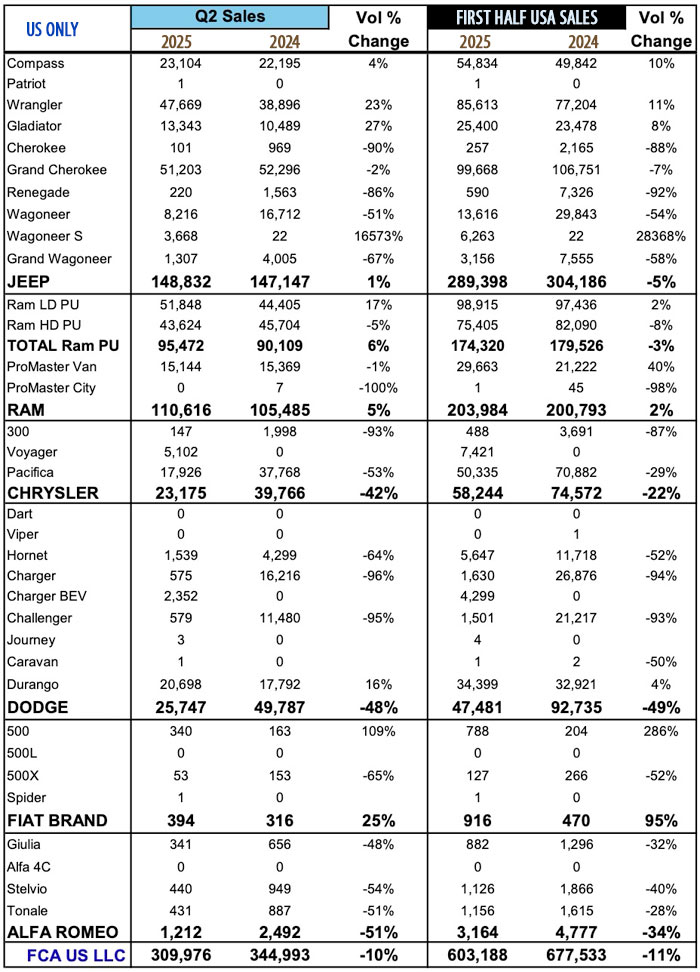

GM, Ford, Toyota, Hyundai, and Kia all posted healthy sales gains as Stellantis turned in a 10% loss for the quarter (11% for the year to date).

Unusually, Ram split out its 1500 from its heavy duty trucks (2500 through 5500). The Ram 1500 gained in sales, by 17%, while the heavy duty fell by 5%. The Ram 1500 currently has a choice of V6 or I6, while the heavy duty series is Hemi V8 or Cummins powered. The obvious solution, according to Ram, is to add a V8 option to the Ram 1500.

No vehicle posted 100,000 sales—not even the Ram pickup series. Year to date, the Ram pickups, together, did rise to 174,320, but neither Ram series broke six figures on its own.

Jeep and Ram both posted gains, with Jeep rising by 1% as the Wagoneer S arrived and Wrangler and Gladiator both had sharply increased sales. The Compass was about the same, rising 4% (around 900 sales). Wagoneer S had 3,668 sales in the second quarter. The Wagoneer and Grand Wagoneer both fell to less than half their Q2 2024 numbers, though. Grand Cherokee remained about the same.

ProMaster sales were steady, and Ram posted a 5% gain, coming in as the #2 Stellantis brand in the U.S.

Dodge and Chrysler unusually showed nearly the same number of sales, as Dodge’s range was cut to one new car with almost no availability, an expensive compact crossover, and the old Durango. The Charger BEV had 2,352 sales, but availability was tight at many dealerships as the ramp-up went slowly; selling 2024 models at full price turned out to impact sales as well. The Hornet barely checked in, with 1,539 sales (down 64%), while Durango posted a healthy gain of 16% to 20,698. As a whole, Dodge was down by 48%.

Chrysler, with just the one vehicle sold under two names, still fared better, with 23,028 Pacificas and Voyagers selling (5,102 Voyagers). Another 147 sales were leftover 300s, down from selling around 2,000 leftover 300s in Q2 2024. Minivan sales were down by around 39%, and Chrysler as a whole was down 42%, ending up with 23,175 sales. Perhaps buyers are waiting for the anniversary edition, pictured below.

This means that the Kia Carnival outsold the Chrysler minivan series collectively, and by a good margin. It is the first time that’s ever happened, including if one includes the prior Kia minivan.

Fiat rose by 25% with the arrival of the 500e, but still only claimed 394 sales for the quarter—less than the leftover Chargers. Alfa Romeo dropped by 51%, with every model falling to about half its Q2-2024 numbers.

Year to date, Jeep is down 5%, Ram is up 2%, Chrysler is down 22%, Dodge is down 49%, Alfa is down 34%, and Fiat is up 95% (but to 916, which is 153 cars per month).

Stellantis bullet points follow the table.

Stellantis pointed out a number of high points, including pointers to future product such as the four-door Charger Daytona and Hemi Ram 1500. In addition, they noted that Grand Cherokee retail sales gained 5%, and that it was the top selling full size SUV (their claim). Durango retail sales rose by 36%, an impressive number (they did not provide the time period for this). Chrysler minivan retail sales rose by 1% (5% in the first half).

Tesla numbers came in after Stellantis, showing a 13% drop. Cybertruck sales fell off a cliff after a mildly promising start, and the X and 3 are both rather old; the Model Y was recently updated, which may be why sales haven’t fallen further. Volkswagen and Audi both fell, along with Nissan, though Nissan had higher retail sales. Automotive News noted that 19% buyers are paying $1,000 per month.

David Zatz started what was to become the world’s biggest Mopar site (Allpar) in 1994. After a chemo-induced 2007-2010 break, during which he wrote car books covering Vipers, minivans, and Jeeps, he returned with Patrick Rall to create StellPower.com for daily news, and to set up MoTales for mo’ tales (Chrysler history and “permanent” car and truck pages). He most recently wrote Century of Chrysler, a 100-year retrospective on the marque.

Discover more from Stellpower - that Mopar news site

Subscribe to get the latest posts sent to your email.