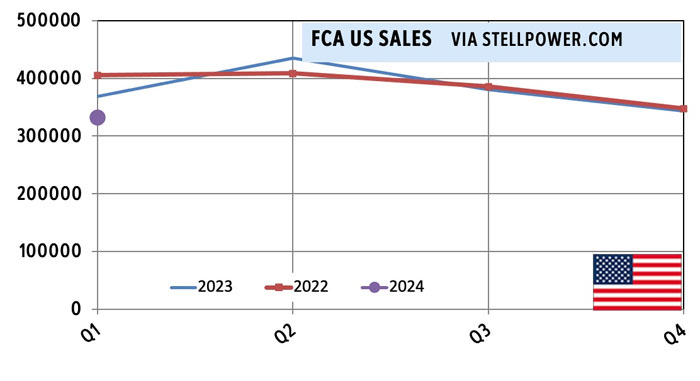

The former Chrysler, FCA US, reported a 10% drop in first-quarter 2024 sales compared with the first quarter of 2023—despite a 2% gain in Jeeps. At Chrysler Canada, sales fell by 20%, from 40,073 to 32,197; every marque but Alfa Romeo fell, and the existing Giulia and Stelvio both fell by double digits, to just 108 combined (around 36 per month across the country).

USA sales. While Dodge stopped making Chargers and Challengers in 2023, the marque still makes Hornets and Durangos; and many dealers still have good inventories of Chargers and Challengers. The only other models dropped in 2023 were the slow-selling Promaster City and the Jeep Cherokee; the latter is due to be replaced in 2024.

At Jeep, the news was almost uniformly good; the only drop was for the Gladiator, which fell by 4% (not counting the discontinued Cherokee). The Grand Cherokee was roughly stable, giving up fewer than 50 sales and leaving 54,455 to be once again the best selling Jeep. The Wagoneer more than doubled its sales figure, hitting a respectable 13,131 for the quarter—not including 3,550 luxury Grand Wagoneers. The Wrangler gained slightly to 38,308 despite competition from the Bronco, and the Compass rose quite a bit (19%) to 27,647. Jeep ended up as the most popular of all the former Mopar marques, with 157,039 sales.

It’s impossible to tell how popular the two and three row Grand Cherokees are separately, except in Canada, where we find that the two-row had 292 sales compared with 2,998 sales for the three-row. That’s roughly a 10-to-1 ratio, which doesn’t bode well for future two-row Grand Cherokees. At some point Jeep may well cede the two-row market to the future Cherokee.

Chrysler also posted a gain, with Pacifica going up 15% to 33,114. The Chrysler 300 fell by roughly half to 1,693 sales, but overall, Chrysler was up by 9%. Minivan sales, if they hold steady, should break six figures.

At Dodge, the story not as good; sales fell by 16%, with Charger taking the biggest hit, falling to half its prior volume and ending at 10,660—less than Wagoneer. Challenger came in at 9,737, but that was just a 14% drop. The Durango was the sales leader, unchanged from 2023; but sales dropped by 13% to 15,129. Finally, the Hornet posted a respectable 7,419 sales, despite still being supply constrained in January and a specialty vehicle regardless. All Dodges but the Hornet were sold with V8 engines during this period.

Ram dropped by 26%. ProMaster City sales dropped from 5,678 to just 38, which is not surprising since it was discontinued; but ProMaster van sales, which had been on a tear, fell from 17,694 to 5,853. ProMaster had gained from massive Amazon fleet sales, but its main rival there, Rivian, has increased production. The Ram pickup and chassis cab series, worryingly, fell by 15% from 105,350 to 89,417. There were few changes from 2023 to 2024, and any Rams with V8s in 2023 are still sold with V8s in 2024. Some buyers may be waiting for the announced 2025s.

Over in Little Italy, Fiat posted its first gain in ages, rising 12% to 154 cars sold—41 500s and 113 500Xs—due to the launch of the 500e. Alfa Romeo’s Giulia and Stelvio both dropped by over a third, but with the new Tonale added in, sales only fell by 4%. The Grand Wagoneer, despite derisive comments on social media about slow sales, outperformed all of Alfa Romeo and Fiat combined; and each one likely makes quite a large profit, given how much it shares with the Wagoneer.

Canada, PHEVs. American PHEV sales were influenced by a major sales push in California-emissions states, a push which, to a degree, ended last week with a new agreement between FCA US and California’s CARB. In Canada, a better picture of demand comes up. We see that the Tonale PHEV outsold the gasoline-only model by 2:1, while the Hornet PHEV was undersold somewhat by the regular Hornet—but the PHEV was only available for part of the time, while the Hornet was on sale, to some degree, for the full quarter. While they were not reported separately, the Grand Cherokee 4xe rose by 7% and the Wrangler 4xe by 18% in Canada.

The following chart shows sales by model for the US and Canada.

| Model | Q1 2024 US | Q1 ’23 | US Change | Q1 ’24 CA | Q1 ’23 | CA Change |

|---|---|---|---|---|---|---|

| Compass | 27,647 | 23,209 | 19% | 2,198 | 1,069 | 106% |

| Wrangler | 38,308 | 37,971 | 1% | 3,663 | 5,010 | -27% |

| Gladiator | 12,989 | 13,575 | -4% | 688 | 612 | 12% |

| Cherokee | 1,196 | 13,213 | -91% | |||

| Grand Cherokee | 54,455 | 54,502 | 0% | 292 | 439 | -33% |

| G. Cher. L | included | incl. | n/a | 2,998 | 3,528 | -15% |

| Renegade | 5,763 | 4,129 | 40% | 35 | 61 | -43% |

| Wagoneer | 13,131 | 5,560 | 136% | below | below | n/a |

| Grand Wagoneer | 3,550 | 2,044 | 74% | 153 | 160 | -4% |

| JEEP | 157,039 | 154,203 | 2% | 11,016 | 12,551 | -12% |

| Pickup/C-C | 89,417 | 105,350 | -15% | 15,960 | 20,125 | -21% |

| ProMaster Van | 5,853 | 17,694 | -67% | 484 | 1,393 | -65% |

| ProMaster City | 38 | 5,678 | -99% | 1 | 204 | -100% |

| RAM | 95,308 | 128,722 | -26% | 16,445 | 21,722 | -24% |

| 200 | -1 | 0 | n/a | |||

| 300 | 1,693 | 2,989 | -43% | 131 | 301 | -56% |

| Caravan | 0 | 0 | n/a | 609 | 601 | 1% |

| Pacifica | 33,114 | 28,910 | 15% | 782 | 1,300 | -40% |

| CHRYSLER | 34,806 | 31,899 | 9% | 1,522 | 2,202 | -31% |

| Viper | 1 | 0 | n/a | 0 | 0 | N/A |

| Hornet | 7,419 | 22 | New | 408 | 4 | 5375% |

| Charger | 10,660 | 22,106 | -52% | 340 | 715 | -52% |

| Challenger | 9,737 | 11,371 | -14% | 782 | 448 | 75% |

| Journey | 0 | 8 | -100% | |||

| Caravan | 2 | 1 | 100% | |||

| Durango | 15,129 | 17,467 | -13% | 1,458 | 2,260 | -35% |

| DODGE | 42,948 | 50,975 | -16% | 2,988 | 3,426 | -13% |

| 500e | 41 | 0 | n/a | |||

| 500L | 0 | 3 | -100% | |||

| 500X | 113 | 135 | -16% | 6 | 5 | 20% |

| 500X | 113 | 135 | -16% | 6 | 5 | 20% |

| Spider | 0 | 0 | n/a | |||

| FIAT | 154 | 138 | 12% | 6 | 5 | 20% |

| Giulia | 640 | 966 | -34% | 33 | 44 | -25% |

| 4C | 0 | 0 | n/a | |||

| Stelvio | 917 | 1,424 | -36% | 75 | 123 | -39% |

| Tonale | 728 | 0 | New | 112 | 0 | N/A |

| ALFA ROMEO | 2,285 | 2,390 | -4% | 220 | 167 | 32% |

| FCA US+CAN | 332,540 | 368,327 | -10% | 32,197 | 40,073 | -20% |

Discover more from Stellpower - that Mopar news site

Subscribe to get the latest posts sent to your email.