Through the auto industry, during days of shortage, it was tempting for companies to jack up prices, since their dealerships were slapping on $5,000 and higher premiums for each new car sold. The difference between Stellantis and others is that they were too slow to cut the prices back again when demand fell to normal levels, and the result is high inventories and one of the few sales drops in the quarter.

FCA US, the USA arm of Stellantis, incidentally dropped far below Hyundai to become the #5 automaker in America (GM, Toyota, Ford, Hyundai, FCA US) despite dropping by 0.8%. Mazda hit six figures, a 13% gain; Honda gained by 17% to challenge Stellantis, 333,824-to-334,841. Nissan’s big discounting push helped it to gain by around 7% but it still ended at 252,735.

The Big Three all beat a half million sales—GM at 590,055; Toyota at 565,098; Ford at 504,815.

As a whole, U.S. light vehicle sales rose by 5.1% in the first quarter. GM retail sales rose by 6% though it lost overall, possibly as decision-makers refused to chase after fleet sales in the face of heavy discounting at Nissan. GM only dropped by 1.5%.

Tesla tried heavy price cuts, due both to competition and, based on market research, customers annoyed with Elon Musk’s statements and activities (most recently a frivolous but devastating lawsuit against a nonprofit which correctly pointed to issues at Tesla). Sales rose by 4%, to 168,500, but apparently plummeted in March.

Part of the problem is heavy discounting of Toyota Tacomas, a common story in the last few months: one company discounts its cars to clear inventory or spur sales, and other companies either follow with price cuts or suffer with bloated inventories. That appears to be a large part of the Gladiator story. Pickups as a whole appear to have dropped—we will have numbers on this soon.

Stellantis’ big drop in sales in the US (and 20% drop in Canada) was not due to the loss of V8 engines. V8-powered cars are languishing on lots across the continent—Durangos (which keep their V8 through 2024), Ram pickups, Chargers, and Challengers are all in stock. Wranglers and Gladiators, save for a few pricey 392 Wranglers, never had V8s to begin with. This is not a reaction to losing the Hemi. They haven’t even lost it yet.

Nor is this entirely due to model year transitions. There are some delays in getting 2025 Ram 1500s out, but none in producing the 2500, 3500, and such; and there are still 2023s and 2024s on dealer lots. It doesn’t seem likely that all the buyers are waiting for the 2025 Ram 1500, though it will be quite nice. The Cherokee’s been out of production for a while, and it is part of the story, but not a large part; the Renegade hardly sold, and Compass seems to have soaked up its sales in any case.

Nor is cost the whole story, since the Wagoneer is doing well. The Wagoneer is a good value, though, in its class. (The Wagoneer went from V8s to Hurricane Sixes while gaining customers for what it’s worth; but the jury is still out on Ram, since if there’s one vehicle class where people want a V8, it’s probably big pickups.)

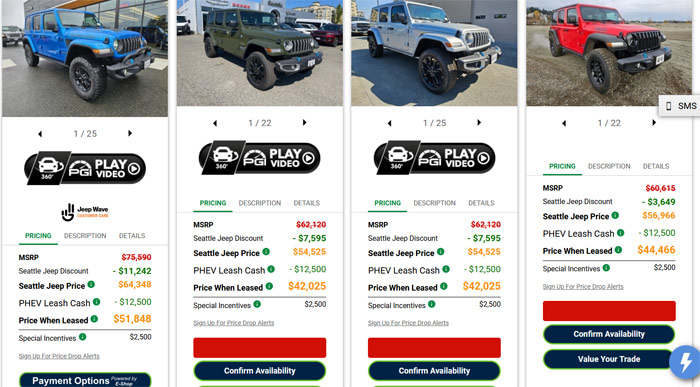

Overall, it’s an interesting mix of sales drops and gains. The company will no doubt adjust pricing to clear the lots; but Jeep has been running deep-price-cut sales all year and it hasn’t done the trick (it probably has hurt lease residuals, though). What they haven’t really done is cut the list price, a tactic that Ford, Chevrolet, Tesla, and others have been using quite publicly. Cutting the list price is less “cheapening” than fire sales and massive rebates, especially with a good story such as “Our own costs have fallen” or “We are cutting our profit margin to help you, the customer.”

This is, when all is said and done, just one quarter—three months. Coming up this calendar year is the Wagoneer S, Recon, new Charger, and 2025 Ram 1500. Most people expect STLA Medium to start up with a Cherokee replacement, some Chrysler cars, and maybe a Dodge or Jeep. Some think a new Challenger may be coming; others think it was subsumed into the Charger and that a new Challenger, a foot shorter from bumper to bumper, will only get the green light if Charger sales are better than most expect. Regardless, this is a year of change for Dodge, Chrysler, Jeep, and Ram, and it may hold some positive surprises that make everyone forget this slow quarter.

Discover more from Stellpower - that Mopar news site

Subscribe to get the latest posts sent to your email.