Stellantis appears to have adopted a strategy of keeping list prices on its cars high, but offering large discounts to clear out cars when sales lag.

There are some advantages to this strategy, all short-term. These are:

- The company rather than the dealer gets the benefit of the higher prices when there are shortages or “hot” cars. Dealers routinely charge thousands over list for cars when they are expected to have waiting lines—Challenger Hellcats, new-generation Vipers, PT Cruisers, and Neons all fit this bill. During the recent car shortages, dealers of all brands tacked on thousands in “market adjustments” in addition to charging full retail. Many automakers jacked up their list prices by thousands of dollars to grab their share of this—Stellantis more than most.

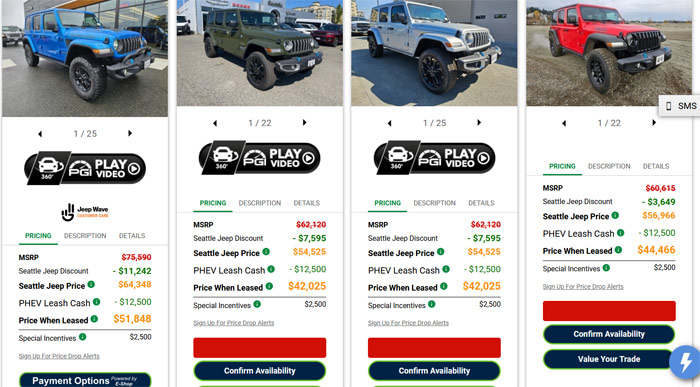

- Many car loan providers (“lenders”) base their financing and down payments on the list price of a car. As a result, a person with even poor credit can finance a Stellantis vehicle, adding in the sales tax, extended warranty, and such, with poor credit; if they were “upside down” on a prior car, they could use discounts to eliminate the negative equity. Subprime vendors are still making these deals, with higher interest rates. However, it appears that lenders are starting to realize this game backfires, and are cutting the amount they will lend. (Thanks, valiant67 from Allpar for this perspective.) Indeed, based on anecdotal evidence, it appears some lenders may be specifically targeting Stellantis, since its list prices are now accompanied by massive discounts, e.g. 13%.

- In theory, the rebate can be made into a down payment.

- In theory, one becomes a “premium” marque by charging more. This has worked for automakers before, but not with rebates or discounts that drop the price back down again.

There are also disadvantages:

- Resale value falls rather quickly to adjust for the list prices being “in name only” which hurts leases.

- Customers who actually paid the higher price can get quite angry.

- It devalues a brand when it’s constantly being sold at a major discount. The cognitive process is something like “If they have to pay people that much to buy it, it can’t be much good.”

- The practice makes companies look desperate and very few people want to buy a car from a company in trouble.

- The cars don’t do very well in comparison tests, because most reviewers don’t add current deals in a magazine to be printed in three months, or want to add current deals on a web page that will be up for years. As a result, a Dodge Hornet, Jeep Gladiator, etc. will appear to be overpriced. Likewise, competitors can honestly say that a customer will pay thousands more for the equivalent Stellantis product.

Chrysler, at least, has tried this strategy before; now and then, the company raises prices but accompanies that with huge rebate. The strategy has never worked; it hurts the brand images over time. Toyota sometimes puts its cars on sale, but generally Toyota does not issue a car and before it’s even in dealerships, tack on $5,000 in rebates. When Toyota sees sales slacken, they tend to do one of three things: drop the price, drop the car, or make a bunch of options into standard equipment. That’s how Toyota responded to softness in compact cars—the Corolla suddenly had more safety features than any other car in its class, without a price increase, and sales responded quickly.

It’s hard to tell right now whether Stellantis plans to use “high prices, high discounts” as a strategy, or whether it’s a tactic to deal with a “temporary” weakness in the market (not that Jeep, for example, will magically have less competition as VW enters the fray) while they wait for a new model year and for new product. The starting prices of the Wagoneer S and Recon and Charger will give a hint as to the company’s choices.

Discover more from Stellpower - that Mopar news site

Subscribe to get the latest posts sent to your email.