FCA US, dominated by former “Mopar” marques, reported drops in US sales both for the fourth quarter and for the full year, but there is more to the story than falling behind Hyundai-Kia.

First, plug-in hybrid (PHEV) sales more than doubled from 2022, helped by the new Hornet and Tonale. The company’s PHEV roster is the Wrangler 4xe, Grand Cherokee 4xe, Pacifica Hybrid, Dodge Hornet R/T, and Alfa Romeo Tonale. The Wrangler is America’s best selling PHEV, the Grand Cherokee is the second best seller, and the Pacifica Hybrid is the third best seller; overall, FCA has a 47% share of the PHEV sales in the USA.

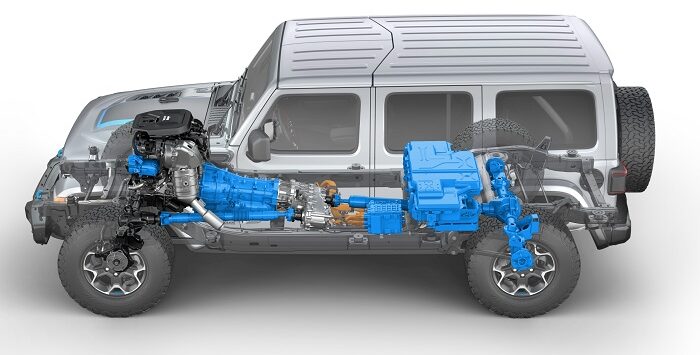

PHEVs combine a short battery-electric range—usually 20-30 miles—with gasoline power as a backup for longer trips. This means they can run as ordinary hybrids and be refilled with ordinary gasoline on longer trips, but for those with reasonably short commutes, they can act as battery-electric cars most of the time. The cost of PHEV setups is a complexity; they aren’t heavier than full battery-electrics (though they are heavier than gasoline-only or ordinary hybrid cars) nor more expensive than battery-electrics (BEVs; though pricier than gasoline or hybrid cars), due to the much smaller batteries. The relatively small battery compared to a full BEV helps with cost and weight. To some degree, PHEVs are an interim step to help FCA US finally hit fuel-economy requirements without buying credits from Tesla, thereby funding a future competitor, but if they are enjoyed by most owners, they might stay on the market for quite some time. (The main steps towards hitting economy goals—more fuel-efficient vehicles and battery-electrics—are both being addressed with numerous 2024-2026 launches, including STLA Medium.)

In the past the Pacifica PHEV had low sales, but it saw a 22% increase in 2023, reaching 23,943 sales—20% of the Pacifica total. It took a 34% of Pacifica sales in the fourth quarter.

The Dodge Hornet R/T took 72% of US Hornet sales, an impressive number given that it was late to arrive and costs more than the ordinary Hornet.

Wrangler 4xe had 67,429 sales, 43% of Wranglers, partly due to Jeep’s decision to make 4xe the only Jeep variant dealers could order “on spec” in certain states (where there was a 4xe version). This was a 56% increase over 2022 in sales. The Grand Cherokee 4xe reached 45,684, 19% of the model’s overall sales.

Moving on to Jeep as a whole, Jeep Wagoneer sales fell by 20% to 29,149 and Grand Wagoneer fell by 10% to 10,618, but were still respectable for a niche car sold at high cost. Wrangler and Gladiator fell by worrying amounts, 14% and 29%, to 156,581 and 55,188; both are still selling reasonably well, again, for niche cars sold at high cost. The Grand Cherokee gained by 10% (244,594) and took an undisputed place as Jeep’s top seller, on the strength of the three-row version; yet Durango sales also grew, by 25%, despite the new internal competition. The newish Compass grew by 12%, making up for a small number of lost Renegade sales, and ended at a reasonable 96,173.

Some have blamed Jeep’s past price increases for its sales problems; the marque has run an “employee pricing for everyone” promotion and some dealers have slashed tens of thousands of dollars from individual Gladiators and Wranglers.

One interesting part of the sales release was the success of the Dodge Hornet when compared to the similar (but not identical) Alfa Romeo Tonale. The Hornet, released after the Tonale, nearly reached 10,000 sales despite inventory restrictions; the Tonale scraped by with 2,096 sales for the year. In the fourth quarter, Dodge sold 4,964 Hornets while Alfa sold 1,233 Tonales. Even so, the Tonale is good news for Alfa Romeo; it was, in the fourth quarter, only 75 sales below Alfa’s top-selling Stelvio. While Alfa sales fell by 15% for the year, they actually gained in the fourth quarter, by 9%. They might have dragged Fiat sales up a little—Fiat enjoyed 178 sales in the fourth quarter, up 51% from Q4 2022, including 28 discontinued-124 sales.

Automotive News pointed out that Jeep broke a trend of nine quarterly declines; Ram actually rose 4% in the fourth quarter after falling through the year.

At Ram, the ProMaster had a renaissance thanks partly to Amazon’s discovery that it was more economical or reliable than Ford Transits; sales rose by 34% to 81,663. Ram pickup/chassis cabs fell by 5% to 444,926, still enough to nearly double the company’s #2-selling Grand Cherokee.

The company’s fortunes are likely to change during a very busy 2024, which will see the launch of a new Jeep Recon and Wagoneer S model, both battery-electric only; and a new range of Chargers and possibly Challengers. The Ram 1500 REV battery-electric is also due for 2024 along with new, Hurricane-powered 2025 Ram 1500s.